2024 Country Update

National PV Policy Programme

With solar increasingly competitive in Australia, national programmes that support deployment are drawing to a close, being replaced by initiatives that support the integration of storage, demand management, load shifting and grid improvements, among others.

The Large Scale Renewable Energy Target (LRET) of 33 000 GWh of renewable electricity annually has been met, with the installation of close to 9 GW of solar installations with a capacity over 100 kWp. Systems over 100kW still receive tradeable certificates for energy generated. The larger challenge for utility scale solar is curtailment due to excess solar. As a result programmes now focus around demand shifting and storage.

Support for small-scale systems (up to 100 kWp) will continue through to end 2030, with an uncapped Small-scale Renewable Energy Scheme (SRES) based on certificates (STCs) for the amount of generation they are be deemed to produce until the end of 2030. This means that the STCs for small systems act as an up-front capital cost reduction. The value of the STCs is decreasing every year toward 2030.

Complementing the national programmes, the Australian Renewable Energy Agency (ARENA) holds a portfolio of 883 million AUD in solar projects) from R&D to deployment (ARENA Annual Report, 2024. ARENA was established by the Australian Government to improve the competitiveness of renewable energy technologies and increase the supply of renewable energy in Australia. The agency supports the global transition to net zero emissions by accelerating the pace of pre-commercial innovation.

With over 40% of free-standing homes, and over 1.4kW per capita installed PV, policy is now framed around dispatchable capacity. As a result, in late 2023, the Australian Government announced an expansion of the Capacity Investment Scheme to target a total of 32 GW of new capacity nationally, made up of 23 GW of renewable capacity and 9 GW of clean dispatchable capacity that will be rolled out from 2024 to 2027.

Informed by a detailed analysis of the solar supply chain, in March 2024, the Australian government committed $1 billion to an initiative to building Australian solar PV manufacturing capability and supply chain resilience.

National programmes in support of solar PV are also complemented by State based schemes, that seek to attract new investment in clean energy projects. Examples include Renewable Energy Zones (REZs) that aim to combine utility scale solar with wind, storage and high-voltage transmission to deliver energy to load centres. By co-ordinating investment, connection and location with respect to load, multiple generators and storage, the REZ can capitalise on economies of scale to deliver cheap, reliable and clean electricity.

Research, Development and Demonstration

PV research, development, and demonstration are supported at the national, as well as the state and territory level. In 2024, research was funded by the Australian Renewable Energy Agency (ARENA), the Australian Research Council and Co-operative Research Centres. ARENA is the largest funder of photovoltaics research in Australia.

The Australian Centre for Advanced Photovoltaics (ACAP), funded by ARENA, started its second term in 2023, to coordinate solar PV research nationally. ACAP is hosted at UNSW and stage two will run until 2030, supported by 45million AUD in ARENA funds and over 10 million AUD in cash from partners.

ARENA also funded a host of new research initiatives in 2023, with close to 40 million AUD over eight years, under an Ultra Low-Cost Solar programme, aiming to drive the levelised cost of electricity from large-scale solar down from the current 50 AUD/MWhr to below 20 AUD/MWhr.

In addition, the federal government, under its Education inistry, supported an initiative in research acceleration in the area of Recycling and Clean Energy (TRACE) with a programme stream on solar technologies. The programme has an ambitious goal to move rapidly to and to establish an innovation ecosystem to get research solutions to market faster.

Australia is active in all IEA PVPS tasks and takes a leadership role as Co-Operating Agent in Task 12, Sustainability and Task 18, Off-Grid and Fringe of Grid PV.

Industry and Market Development

Australia saw an estimated 4 GW of solar installed in total in 2024, with 2.9 GW of rooftop solar and 1.1 GW of utility scale solar. This number is expected to increase to around 4.2 GW once all new installations are reported. If so, the market remains stable at 4.2 GW. Total installed solar capacity is now ~38.6 GW.

We continued to observe a decline in solar costs, with the average price per watt (after incentives) dropping to $0.90 by December 2024, down from $1.05 in the previous year.

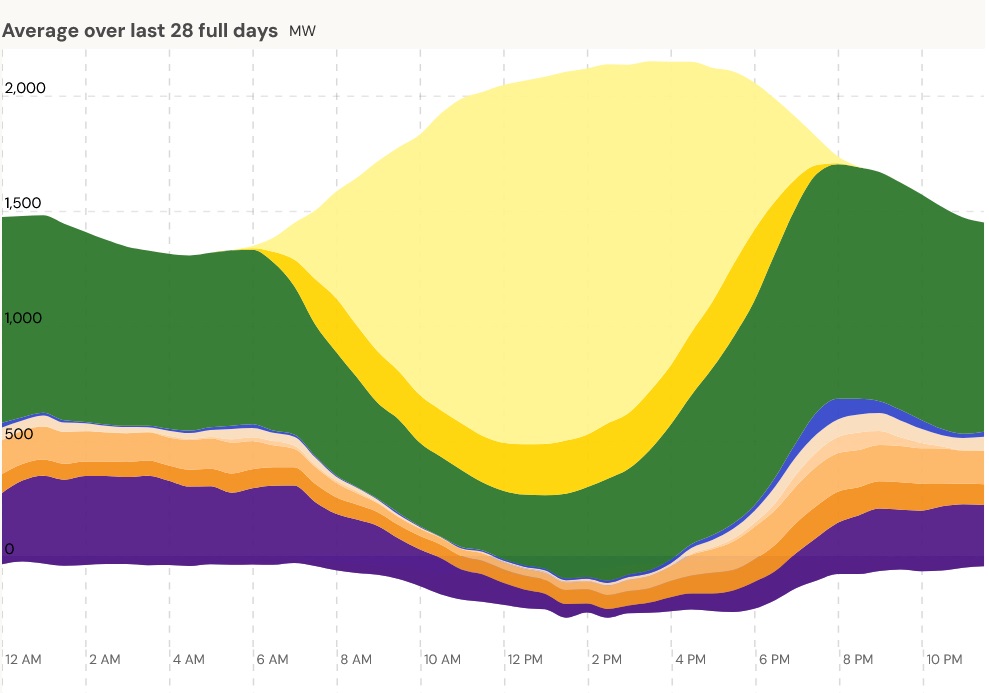

Rooftop solar claimed an annual average fraction of total electricity demand of generation of around 13%, while large-scale solar projects contributed over 6% for a total 19% of electricity needs being met by solar over 2024. In mid-Spring (October), Australia’s main grid reached a record renewable (wind and solar) share of more than 47 percent in the month of October, while South Australia delivered a renewables share equivalent to 85.2 percent of state demand.

The Australian storage market remained strong in 2024, with the Clean Energy Regulator now tracking and reporting battery installations. Over 28 262 new batteries were recorded as installed with small scale solar systems in 2024. Australia has now seen 122,000 batteries installed since 2014.The industry reports significantly higher numbers, reflecting a lack of systematic reporting to the Clean Energy Regulator.

The Australian market remains favourably viewed by overseas battery/inverter manufacturers due to its high electricity prices, low feed-in tariffs, excellent solar resource, and large uptake of residential PV. There are also a large number of large-scale battery deployments called for, as excess solar in the middle of the day results in curtailment, and evening peaks challenge grid capacity.

2025 is expected to see stability in residential rooftop solar and continued growth in commercial and industrial installations. The economic fundamentals for residential and commercial PV are outstanding. Australia’s high electricity prices and inexpensive PV systems means payback can commonly be achieved in 3-5 years; a situation that looks set to continue in 2025.

Renewed investment in large scale solar and batteries is expected to start to yield projects and connections in 2025, with a pipeline of projects aimed at 23 GW of renewable capacity and 9 GW of clean dispatchable capacity to be delivered before 2027.

Participants from Australia

Australian PV Institute (APVI), University of New South Wales (UNSW)

EGAN Renate

Sustainable Energy for All

COLDREY Olivia

Task - 1

Australian PV Institute (APVI), University of New South Wales (UNSW)

EGAN Renate

University of New South Wales (UNSW)

KOSHIER Linda

Task - 12

University of New South Wales (UNSW)

DENG Rong

SHEN Yansong

Task - 13

Murdoch University

PARLEVLIET David

RINA Tech

RODRÍGUEZ-GALLEGOS Carlos D.

Task - 15

University of Melbourne

YANG Rebecca

Task - 16

University of New South Wales (UNSW)

KAY Merlinde

University of South Australia (UniSA)

BOLAND John

Task - 17

IT Power Australia

MCDONALD Julia

University of New South Wales (UNSW)

EKINS-DAUKES NJ

Task - 18

Ekistica

RODDEN Paul

Global Sustainable Energy Solutions (GSES)

MARTELL Christopher

STAPLETON Geoff

Task - 20

University of Adelaide