2024 Country Update

National PV Policy

South Korea finalised and announced the 11th Basic Plan for Electricity Supply and Demand in February 2025, which was originally scheduled for completion in 2024, following discussions that began in July in 2023.

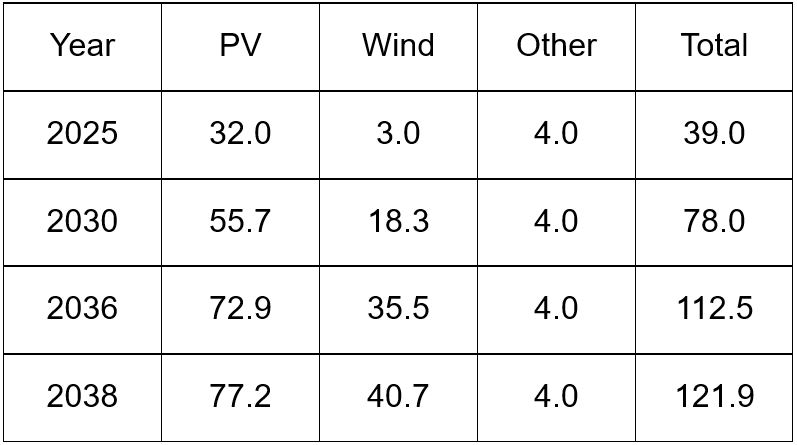

Disagreements over the scale of new nuclear power plant construction delayed the process, resulting in its confirmation approximately 19 months later. This Basic Plan, which is revised every two years and outlines a 15-year outlook, presents projections for power supply and facility deployment from 2024 to 2038. Taking into account the 2030 Nationally Determined Contribution (NDC) targets, the plan outlines a pathway to accelerate the deployment of solar and wind energy through coordinated, cross-ministerial policy efforts. It sets a goal of adding an average of 7 GW of solar and wind capacity annually by 2030.

The year 2024 marks a period during which the South Korean government has been actively seeking ways to reverse the stagnation in solar deployment observed in recent years. The major policy efforts can be summarised as follows:

- Strategies for Expanding Supply and Strenthning the Supply Chain for Renewable Energy. In May 2024, the Ministry of Trade, Industry and Energy (MOTIE) announced Strategies to ensure the stable deployment of around 6 GW of solar and wind energy annually while strengthening the domestic renewable energy industry. The strategy addresses challenges such as site conflicts, grid constraints, and costs, while promoting technological self-reliance and local manufacturing. Key measures include support for domestic solar modules, activation of self-consumption PPAs—especially in commercial and industrial sectors—and streamlined permitting and institutional support to attract investment. These efforts align with expected RPS reforms and aim to create a more stable, investor-friendly environment for solar PV.

- 11th Basic Plan for Electricity Supply and Demand. Compared to the above-mentioned Strategies, the finalised Basic Plan raises the 2030 solar energy target by an additional 1.9 GW. It also includes measures to strengthen grid stability, such as grid expansion and the deployment of backup systems like ESS. The cumulative solar PV installation target is set at 55.7 GW by 2030 and 77.2 GW by 2038.

- National Strategy for the deployment of agrivoltaics. In April 2024, the Ministry of Agriculture, Food and Rural Affairs announced a strategy to promote agrivoltaics, aiming to boost farmers’ income while ensuring food security. The strategy positions farmers as key participants, supported through institutional measures, insurance, and training. Key measures include encouraging the use of lower-quality farmland, extending temporary land-use permits from 8 to 23 years, providing incentives for projects in designated renewable energy zones, and establishing a strict management system to ensure continued agricultural activity.

- Special Act on the Promotion of Distributted Energy. The Act enacted in June 2023, which came into effect in June 2024, provides a legal framework to promote diverse solar PV models—such as agrivoltaics, floating, and building-integrated systems—through distributed energy zones, regulatory easing, and enhanced local government participation.

Research, Development and Demonstration

In December 2024, Hanwha Qcells achieved a power conversion efficiency (PCE) of 28.6% with its self-developed tandem solar cell on a large-area M10 wafer.

This achievement received official certification from the Fraunhofer Institute for Solar Energy Systems (Fraunhofer ISE) in Germany. It marked the first time in the world that a tandem solar cell of such a large area (330.56 cm²), applicable to commercially available modules, was certified by an independent third-party institution.

The previously mentioned Strategies for Expanding Supply and Strengthening the Supply Chain for Renewable Energy also outline key initiatives for the development of solar PV technologies. At the heart of this strategy is government support for strategic R&D, aimed at the early commercialisation of next-generation tandem solar cells and achieving a conversion efficiency of 35% by 2030. To support these efforts, the government promoted the establishment of the Centre for Advanced Solar PV Technology (CAST), which was inaugurated in Daejeon in March 2024. This centre serves as an open innovation platform for pre-production verification of solar cell technologies developed by PV-related industries. It is designed to consolidate research capabilities across industry, academia, and research institutes in the areas of next-generation tandem cells, modules, and measurement technologies. The centre is equipped with a 100 MW-scale pilot production line capable of manufacturing solar cells up to M12 size and modules. It also conducts R&D on reliable measurement and evaluation techniques for next-generation solar PV technologies such as tandem cells.

In addition, Korea undertook various efforts in 2024 to promote the development of solar PV technologies as outlined below:

- Strategy for Next-Generation Solar Cell Technology Development and Early Commercialisation: On November 14, 2024, MOTIE held a task force (TF) meeting to discuss the strategy for the early commercialisation of tandem-type next-generation solar cells. The TF has conducted several working-level sessions since its first meeting in January 2024. The strategy focuses on goal-oriented R&D across the entire value chain—including cells, modules, and materials. It involves the formation of public-private working groups, the design of mission-driven R&D programs, and enhanced collaboration among companies to accelerate commercialisation.

- Strategy for Technology Innovation for Carbon Neutrality: The government has established the “Roadmap for Innovation in 17 Core Technologies” as part of its strategy to achieve carbon neutrality. This roadmap has been developed in phases since 2022 and was finalised on December 12, 2024, during the 9th meeting of the Special Committee on Carbon Neutral Technologies, hosted by the Ministry of Science and ICT. The solar PV sector focuses on the development of ultra-high-efficiency solar cells, diversified applications of solar PV systems, and technologies for the reuse and recycling of end-of-life modules.

- 5th National Energy Technology Development Plan: On December 18, 2024, MOTIE finalised the Plan, which outlines a mid- to long-term investment strategy in energy R&D. In the solar sector, it specifically supports the commercialisation of tandem solar cells, the development of solar power systems with a levelized cost of electricity (LCOE) below $0.03/kWh, the development of standardised technologies for solar operation and maintenance (O&M), and the minimization of carbon emissions throughout the entire lifecycle of solar technologies.

- Action Plan for Development and Promotion of New and Renewable Energy Technologies: On December 19, 2024, MOTIE announced the 2024 Action plan under the “Act on the Promotion of the Development, Use, and Diffusion of New and Renewable Energy.” The plan includes detailed actions to promote both R&D and the deployment of renewable energy technologies.

As part of international collaborative research, Korea is participating in the SOLMATES project (Horizon-CL5-2022-D3-03-05), which held its kick-off meeting in Innsbruck, Austria, in January 2024. SOLMATES stands for Scalable High-power Output and Low-Cost Made-to-measure Tandem Solar Modules Enabling Specialised PV Applications.

Industry and Market Development

The deployment of solar PV in Korea is currently dominated by utility-scale installations for power generation. As of 2023, the cumulative installed solar capacity totalled 28.0 GW, of which 24.2 GW—approximately 86%—was accounted for by utility-scale power generation projects.

In contrast, residential installations made up 2.2 GW (8%), industrial and commercial applications 1.3 GW (5%), and other uses only 0.3 GW (1%). These figures are derived from the nationally approved “Renewable Energy Deployment Statistics” published by the Korea Energy Agency and restructured by application category. The data clearly indicate that Korea’s solar PV deployment heavily relies on privately operated, utility-scale business models.

According to the Export-Import Bank of Korea, the domestic solar PV market is expected to maintain an annual installation level of around 3 GW through 2030. However, to meet the 2030 target outlined in the Basic Plan, an average of 4.5 GW of new solar capacity must be installed annually. Extending the timeline to 2038, this translates to an average of approximately 3.5 GW per year. Given that the current short-term target is around 4 GW annually over the next two years, more aggressive efforts will be necessary to stay on track.

Considering Korea’s industrial structure, which is heavily reliant on manufacturing and exports, demand for renewable energy—particularly in response to global initiatives such as RE100—is expected to grow. In this context, demand-driven deployment models such as PPAs, which allow companies to voluntarily secure renewable energy, are likely to expand. This indicates a potential shift from a utility-centred deployment structure toward more self-consumption and distributed energy systems in the future.

Although the solar PV market in Korea has strong growth potential, it still faces several structural challenges, including grid constraints, policy uncertainty, complex permitting processes, high generation costs, declining profitability, and supply chain vulnerabilities. Small-scale and distributed solar systems, in particular, suffer from insufficient institutional support, which limits their expansion.

The aforementioned renewable energy strategies and government policies have been designed to address these challenges. Furthermore, the 2nd Presidential Commission on Carbon Neutrality and Green Growth, launched on February 27, 2025, convened its Energy and Just Transition Subcommittee on March 25 to discuss institutional reform measures. Key initiatives announced include mandating solar PV installations at 2,995 public parking lots, establishing guidelines to expand the available area for floating solar systems on multipurpose dams, and launching a funding program for local governments to ease setback regulations related to solar installations. These efforts, along with a range of other cross-sectoral policies, are expected to have a positive impact on the future expansion of solar PV in South Korea.

Participants

Korean Energy Agency (KEA)

HEO Youngjun

Korean Institute for Energy Research (KIER)

GWAK Jihye

Task - 1

Kentech

PARK Chinho

Task - 15

Kongju National University