2024 Country Update

National PV Policy

In 2024 the new government decided to gradually phase out the successful net metering scheme for smaller systems and stop it altogether in 2027.

Also subsidy schemes for electric vehicles and heat pumps were cancelled. After much debate this decision was finally taken considering; the declining prices of solar panels which shortens the return on investment period, some grid and operational cost for solar are socialised over all citizens, the decline in tax revenues and the still increasing grid congestion. Instead, a “reasonable” remuneration will have to be negotiated between prosumers and their energy supplier which will be supervised by the Netherlands Authority for Consumers and Markets (ACM).

In the SDE++ category for larger systems (> 15 Kwp) the existing categories were expanded to:

- solar panels on roofs which need reinforcement or the use of lightweight panels on the same roofs

- ground mounted solar parks which include and enhance the ecological value of the terrain

The ACM presented a number of measures to combat grid congestion among others:

- non-firm capacity contracts targeting the largest energy users;

- time of use for large energy users for load shifting;

- participation obligation for private grids;

- societal priorities for grid connection like hospitals;

- use it or lose it, large users who do not make use of their capacity over a longer period of time must return it;

- backward banking is no longer allowed for SDE++ solar or wind parks. Yearly solar production higher than the established maximum for subsidy can no longer be transferred to a year with lower yearly production to compensate the difference.

In 2024 many of the policies from the previous government are still in place but for 2025 more and additional changes are expected. The former ministry of Economic Affairs and Climate is now split between a Ministry of Economic Affairs and a Ministry for Climate Policy and Green Growth.

The Netherlands remain committed to achieving net zero carbon emissions by 2050. The transition to sustainable energy forms a key part of this plan. Alongside increasing sustainable electricity production, the Dutch government is prioritising the creation of a national ‘hydrogen backbone’ – an infrastructure network linking the Port of Rotterdam with other major industry clusters in the Netherlands, Germany, and Belgium.

Cybersecurity of the energy infrastructure and combating grid congestion are other priorities of the new government. Grid congestion is still on the increase due not only to more renewable electricity generation but also to greater electricity demand by the industry, transport and housing.

Research, Development and Demonstration

In 2024 the mission oriented R&D programme topics remained largely the same:

- Renewable Energy Production

- Energy Saving

- Flexibility of the Energy System

- Circular Economy

- Natural gas free Neighborhoods and Buildings

In 2024 a large demonstration project for “offshore floating solar” was granted which will start in the summer 2025. In this project the integration with existing offshore wind parks is explicitly sought and so is ecological research on a larger scale. The ecological impact is studied throughout the entire water column under the floating panels to the seabed.

Higher technology readiness levels (TRL) are managed in separate programmes for fundamental research by the national organisations NWO and STW. The research activities themselves are dispersed over several universities and research institutes like AMOLF, DIFFER, Solliance and TNO (the national institute for applied research). For research into perovskites this separation is sometimes problematic since many fundamental questions on a nano scale are found at the interface of material sciences and production technologies where new properties can emerge.

The emergence of new types of solar cells with perovskites gives rise to new start-ups and research agendas.

The National Growth Fund project SOLARNL started in 2023, received strong headwinds in the international market but is making piecemeal progress on specific topics like VIPV, training and education. The three main topics covered are: Si HJT cell factory, Flexible solar foils and Lightweight/integrated PV. SolarNL | National Dutch PV research, innovation and industry programme

The Top consortium for Knowledge and Innovation (TKI) concerning solar, under the flag of Urban Energy, drives innovation by forming partnerships and through matchmaking TKI Urban Energy | Topsector Energie .

Industry and Market Development

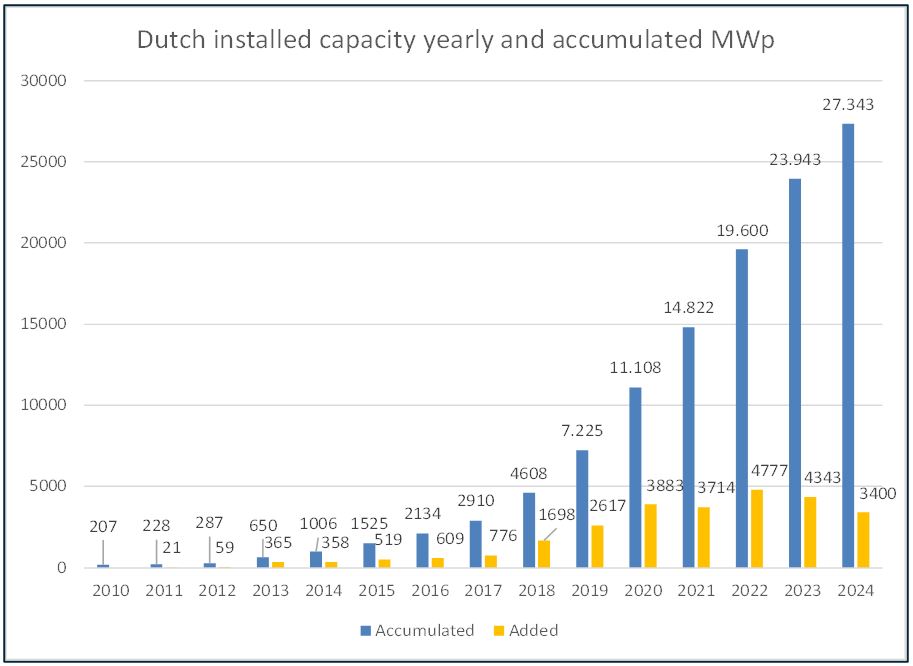

After the accelerated growth of the solar PV market flattened out in 2023 the market for solar panels stabilised in 2024 on a somewhat lower level.

In the first half of the year

1.763.338 kWp was installed (source CBS) and figures over the whole year will be published by the CBS in the month of May. Assuming a similar result for the second half of the year, a total of around 3.4 GWp installed capacity can be estimated for 2024. This amount is lower than in previous years, but monthly figures seem to stabilise.

Both the solar rooftop market and ground-mounted systems have reached levels where the proverbial “low hanging fruit” has been plucked. Over 50% of house owners have now installed solar panels in the Netherlands while the rental home market falls behind with an estimated 20%. On business parks and utility construction there is still much space, but congestion and split incentives obstruct a fast roll-out. All markets are therefore changing towards more integrated products and higher degrees of self-consumption within the home, company or so- called energy hubs.

Homeowners are increasingly combining solar panels with home battery storage which will have to be integrated with energy management systems (EMS) and the same goes for EVs if dynamic charging is involved. Heat pumps are another enabler of solar PV, and its market share is on the rise but still an early adopter market.

Solar parks can already use battery storage and cable pooling to relieve the national grid. The national grid operator Tennet has reduced transport tariffs to a maximum of 65% for larger solar parks with battery storage and expects an increase with these measures up to 5 GW of battery capacity for flexibility.

The niche market of BIPV remains predominantly a business-to-business market notwithstanding government initiatives that target renovation of the existing building stock and social housing in particular.

VIPV is taking off in the market segment for trucks and semi-trailer.

Participants

Netherlands Enterprise Agency RVO

BERNSEN Otto

Task - 1

Netherlands Enterprise Agency RVO

BERNSEN Otto

Task - 12

Delft University of Technology

VOGT Malte

Netherlands Organisation for Applied Scientific Research (TNO)

THEELEN Mirjam

SmartGreenScans

de WILD-SCHOLTEN Mariska

Task - 13

Utrecht University

GOLROODBARI Mirbagheri (Sara)

VAN SARK Wilfried

Task - 15

Netherlands Organisation for Applied Scientific Research (TNO)

VALCKENBORG Roland

VILLA Simona

ZUYD

VROON Zeger

bear-ID

REIJENGA Tjerk

Task - 16

Utrecht University

VAN SARK Wilfried

Task - 17

Netherlands Organisation for Applied Scientific Research (TNO)

CARR Anna J.

Task - 18

Delft University of Technology

BAUER Pavol

RAMIREZ ELIZONDRO Laura

Netherlands Enterprise Agency RVO

BERNSEN Otto

Task - 20

Delft University of Technology

BAUER Pavol

Netherlands Enterprise Agency RVO

BERNSEN Otto

VANCHERI Veronika

Task - 19

Eindhoven University of Technology

REINDERS Angele

Netherlands Enterprise Agency RVO

BERNSEN Otto

University of Twente