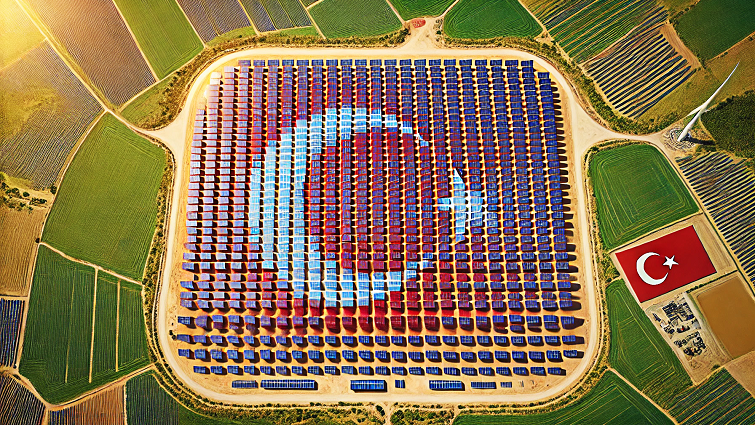

2024 Country Update

National PV Policy

Türkiye's photovoltaic (PV) sector has shown significant growth over the past decade. In 2014, the country had approximately 40 MW of installed solar energy capacity.

The installed capacity of solar electricity in Türkiye increased by more than 70% from 11.3 GW in December 2023 to 20 GW by the end of 2024. Thus, the end-2025 target of 18 GW, set out in the National Energy Plan prepared by the Ministry of Energy and Natural Resources (MENR) and published in 2023, was reached by August 2024. The fact that this target was reached 1.5 years earlier demonstrates Türkiye’s determination to rapidly implement solar energy projects, while also showing the need for a more ambitious revision of the current targets.

In 2022, the increase in unlicensed power plant installations gained momentum with the amendment to the Unlicensed Electricity Generation Regulation, which allows the installation of a power plant in a different distribution region from a different consumption point. This change accelerated investments in self-consumption and contributed to reducing the negative impact of solar power plants on grid interconnection.

With simplified legislation and incentives, the rate of increase in installed solar power capacity has accelerated significantly in recent years. Installed capacity has doubled in the last two years alone. This rapid progress is an important indicator of the progress made by the Turkish solar energy sector and its strong energy infrastructure. In parallel with the increase in installed capacity, the share of solar energy in total electricity generation increased to 7.5% in 2024, with a total of 26 TWh of electricity generated.

As a result of these developments, the Ministry of Energy and Natural Resources updated the Renewable Energy Roadmap in October 2024 and increased the installed capacity of solar and wind-based electricity to 120 GW. In November 2024, the 2030 and 2035 targets were updated in the Long-Term Climate Change Strategy Document published by the Ministry of Environment, Urbanisation and Climate Change at COP29, and the 2035 solar energy installed power target was set at 77 GW.

In 2016, Türkiye introduced the Renewable Energy Resource Area (YEKA) model in its legislation, facilitating the allocation of suitable land to investors for the realisation of large-scale renewable energy projects and aiming to reduce foreign dependency by encouraging localisation in the production of relevant technologies. To date, 3 GW of solar energy has been tendered under YEKA, of which 1.5 GW capacity has been implemented. The results of the last tender held in 2024 were announced in February 2025, providing capacity for another 800 MW of investment. With the amendments made in 2024, the YEKA model was improved in favour of investors with financial incentives such as shortened post-tender permitting processes and exemption from transmission fees.

In 2014, a legal regulation was enacted that paved the way for the establishment of floating solar power plants in Türkiye and included regulations in the field of energy. With this regulation, floating solar power plant applications are expected to increase in Türkiye in the coming years. Thus, in addition to increasing renewable energy capacity, it is aimed to utilise unused water surfaces and prevent water loss due to evaporation.

Research, Development and Demonstration

In line with the 2053 net zero emission target and green development policy of Türkiye 2053, relevant institutions are working to produce groundbreaking R&D and innovation-based solutions.

For this purpose, basic/applied research, technology development and innovation projects are supported to develop photovoltaic cells, panels and systems that have high efficiency and lifetime, are lightweight, flexible and cost-effective, and can be synergistically and ergonomically integrated into applications such as buildings, vehicles, agriculture and water surfaces.

The Turkish Energy, Nuclear and Mineral Research Agency (TENMAK), Clean Energy Research Institute, initiated a study for the recycling of end-of-life or defective solar panels in 2024. The International Energy Agency predicts that the world’s solar energy capacity will exceed 2 000 GW by 2025. The world’s installed capacity is expected to reach 1 630 GW by 2030, of which 1.7–8 million tonnes of solar panels will be scrapped. Considering the increase in end-of-life PV panels and storage systems, it is aimed to investigate effective and efficient recycling methods to improve waste management in solar energy in our country. The Digitalisation of Energy Systems Project Support Call, announced by TENMAK in October 2023, was concluded in 2024, and many projects such as creating a digital twin of solar power plants and increasing the efficiency of solar power plants with artificial intelligence were applied.

In July 2024, the Ministry of Industry and Technology introduced the High Tech Türkiye (HIT-30) programme to support high-tech industrial investments. Under the programme, a total of USD 30 billion worth of incentives will be provided until 2030 in the areas of electric vehicle production, battery production, chip production, solar panel cell production, wind turbine equipment production and R&D. The HIT-Solar call aims to improve the cell manufacturing capabilities of the Turkish panel manufacturing industry. With a total support budget of USD 2.5 billion, it is aimed to create a total annual cell production capacity of 15 GW, including high domestic contribution and R&D centre investments. Within the scope of the call, investments with a minimum annual production capacity of 5 GW, focusing on cell production starting from the ingot stage, will be supported, and investors will be provided with grant support of up to 8 000 dollars per megawatt.

The Türkiye Green Industry Project, funded by the World Bank with a budget of USD 450 million and lasting for six years, aims to support the green transformation of capital companies in Türkiye by TÜBİTAK and KOSGEB. Introduced in 2023, the first application results of the programme were announced in 2024, and more than 100 projects were found eligible for support. In addition to nationally funded projects, research institutions and universities in Türkiye, as well as stakeholders related to photovoltaic technologies, participate in international programmes that support R&D projects through many project calls such as Horizon Europe and IPA-III, coordinated by the relevant institutions of the EU. There are also different programmes for photovoltaic technologies within the scope of bilateral cooperation between countries.

Industry and Market Development

Türkiye has taken significant steps to enhance domestic production in the solar energy sec-tor, positioning itself as a regional manufacturing hub for photovoltaic (PV) cells and modules.

With increasing government incentives, renewable energy targets, and strong investor interest, PV production capacity has expanded rapidly in recent years.

As of 2025, Türkiye hosts several PV cell and module manufacturers with integrated production facilities serving both domestic and international markets. Under the Renewable Energy Resource Areas (YEKA) projects, manufacturers are focusing on developing high-efficiency solar cells and modules.

Crystalline silicon (c-Si) remains the dominant technology in the photovoltaic (PV) industry, and Türkiye has been expanding its role in the upstream production of feedstocks, ingots, and wafers. While Türkiye primarily relies on imports for high-purity polysilicon, recent investments in local ingot and wafer production indicate a strategic shift towards reducing dependence on foreign supply chains.

The prices of TOPCon (Tunnel Oxide Passivated Contact) solar panels in Türkiye can vary depending on the panel’s power, brand, and seller. Furthermore, prices can differ based on the wattage of the panel, cell type, and manufacturer. There may also be price variations and discounts between sellers. The prices of TOPCon modules in the market range between 15.5 and 17 cents/Watt.

Developments in Türkiye’s solar energy sector are supported by the expansion of domestic production capacity. Incentives for local production and new factory investments have driven progress in areas ranging from panel production to cell and wafer manufacturing. International collaborations and new R&D projects have accelerated technology transfer in the sector, strengthening Türkiye’s position in the global solar energy market.

The Turkish solar energy sector offers sector-specific employment opportunities. According to Solar3GW’s report, there are 1 150 companies operating in the solar energy sector, with 43.5% specialising in residential-scale installations. While some firms have professional organisational structures, the sector is still largely dominated by entry-level companies with limited financial strength. The report also deduces that as of 2023, the solar energy sector directly employed approximately 37 000 people. This number can be increased by an additional 10–15% working in related fields, such as the public sector, distribution companies, municipalities, and subcontractors.

In 2024, the World Bank and Türkiye signed an agreement for a USD 1 billion dollar programme in renewable energy. The programme is expected to contribute to the establishment and expansion of Türkiye’s distributed and off-grid solar market and the piloting of a battery storage programme in support of the National Energy Plan. The programme will first provide direct financing to private sector investors developing rooftop and ground-mounted solar energy systems for commercial and industrial customers. The programme will secondly support local commercial banks or leasing companies to provide similar loans to solar investors.

Participants

Turkish Energy Nuclear and Mineral Research Agency (TENMAK)

ATEŞ Ibrahim

TUNÇBİLEK Ömer Faruk

Task - 1

Turkish Energy Nuclear and Mineral Research Agency (TENMAK)

ATEŞ Ibrahim

Task - 18

Middle East Technical University