Task 14 has published a new technical report on Reactive Power Management with Distributed Energy Resources

Task 17 has published a new technical report titled ‘Expert Survey on Technical Requirements of PV-powered Passenger Vehicles’

Task 18 has published a new technical report on the Evaluation of Software Tools for Standalone Microgrid Design and Optimization

Task 12 has published a new technical report on the Status of PV Module Take-Back and Recycling in Germany

Task 12 has published a new technical report on the Environmental Life Cycle Assessment of Passivated Emitter and Rear Contact (PERC) Photovoltaic Module Technology

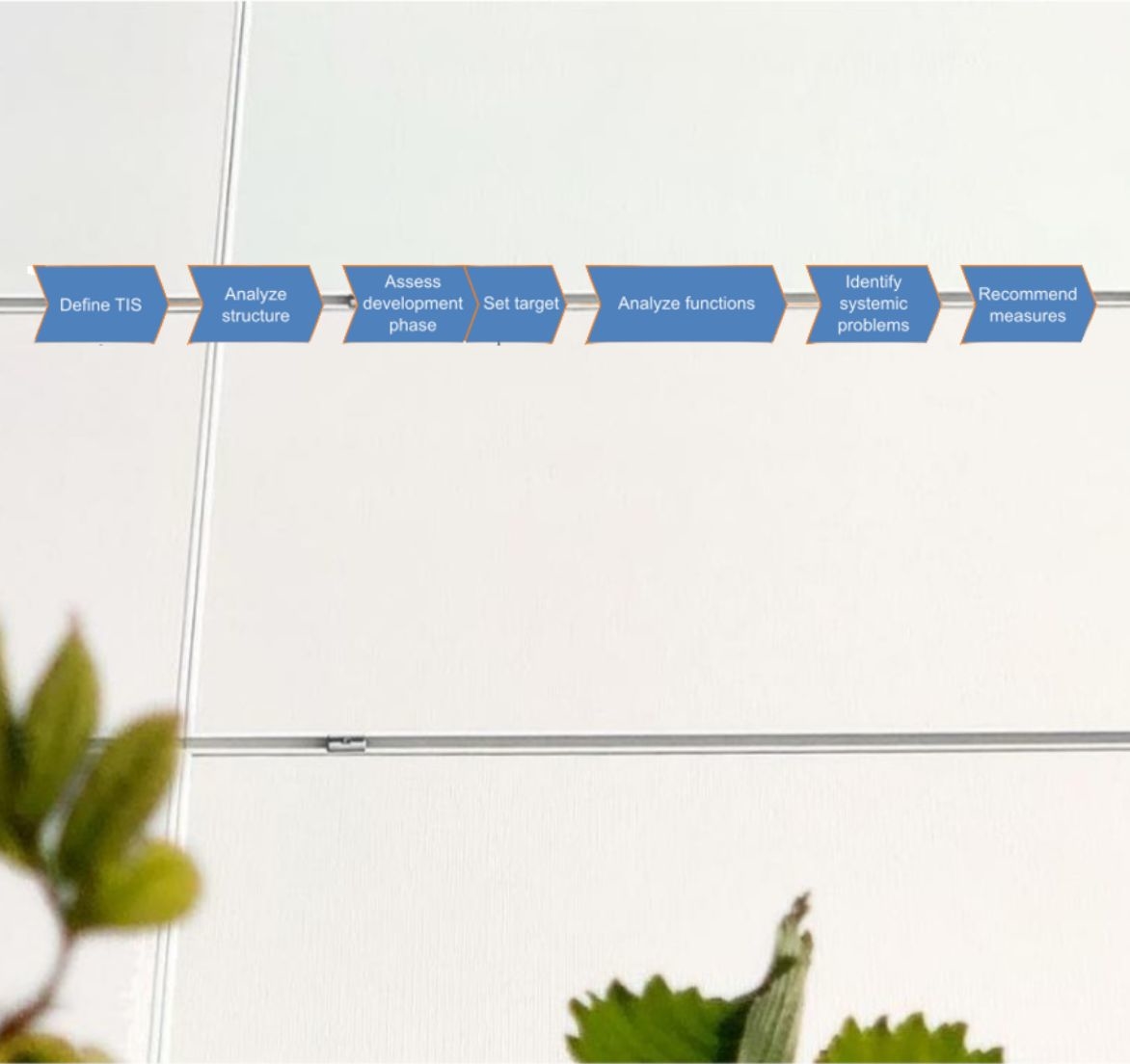

Task 15 has published a new technical report on Analysis of the Technological Innovation System for BIPV in Italy

Task 15 has published a new technical report on Analysis of the Technological Innovation System for BIPV in Sweden

Task 14 has published a new technical report on Active Power Management of Photovoltaic Systems – State of the Art and Technical Solutions

The new IEA PVPS Trends in Photovoltaic Applications 2023 is now available!

Task 15 has published a new technical report on Technological Innovation System Analysis for Building-Integrated Photovoltaics

Task 15 has published a new technical report on Fire Safety Testing for BIPV Products