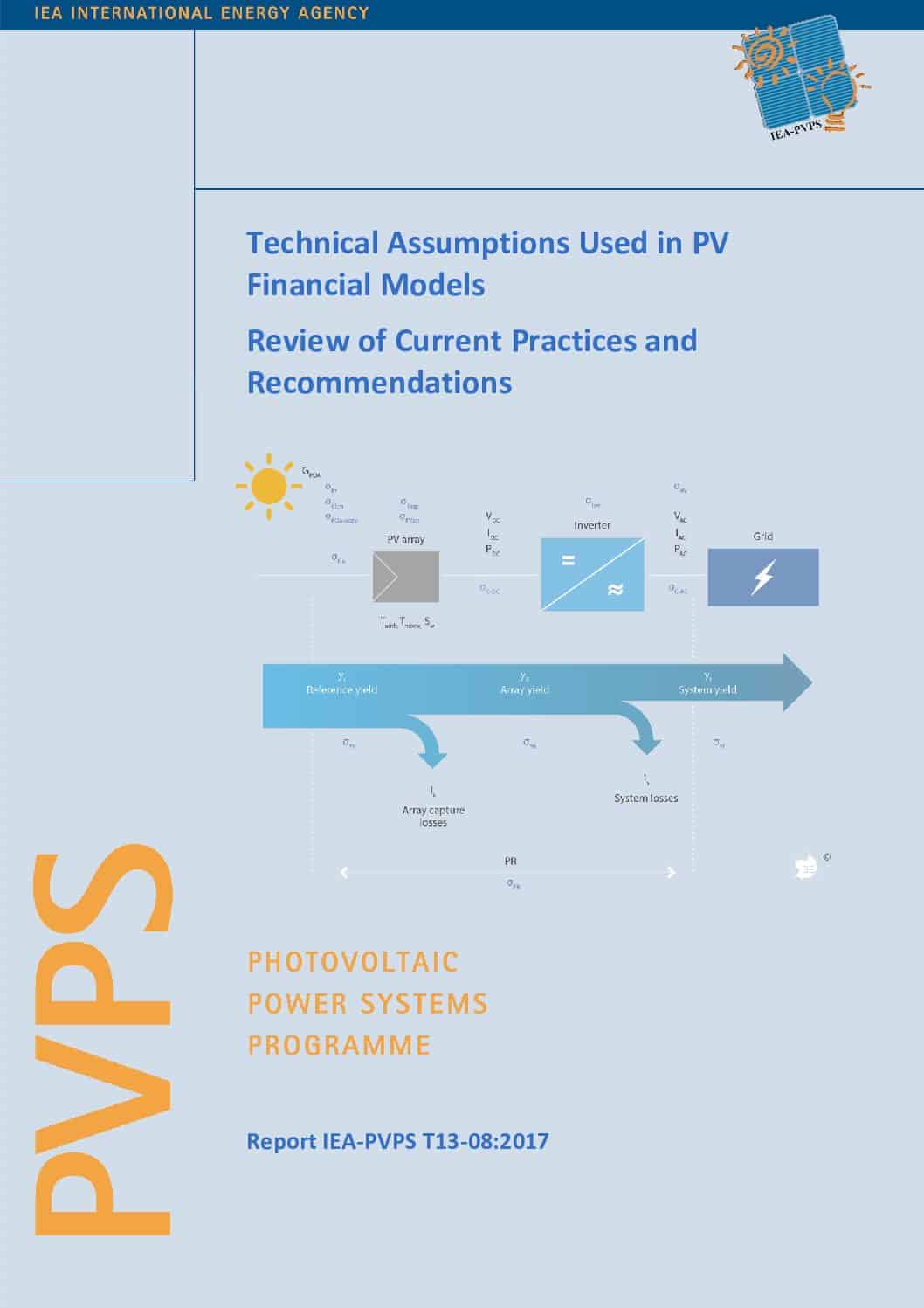

PV financial models are used by project developers, banks and asset managers to evaluate the profitability of a PV project. The objective of this work is to present an overview of current practices for financial modelling of PV investments and to review them in view of technical and financial risks during the different phases of a PV project. This report focuses on establishing common practices for translating the technical parameters of performance and reliability into financial terms. The full report delivers a comprehensive set of practical guidelines and recommendations for mitigating and hedging financial risks in a PV investment.

How do PV Financial Models Currently Deal with Technical Assumptions and Risks?

In order to obtain an overview of current practices on the use of technical parameters in PV financial models, 84 PV projects covering nine countries, several technologies and different business concepts have been screened and evaluated. A questionnaire was developed and distributed among members of the Task 13 Subtask 1 contributors.

The solar irradiation data used for the long-term energy yield estimates are in general collected, analyzed, and assessed with a great deal of professionalism. However, different historical periods (THist) are used depending on the irradiation data source. Moreover, no considerations on possible effects of long-term trends in the solar resource and how to account for these in the LTYA is typically provided. The overall impression on energy yield estimates is that they are calculated by engineers for the specific project and are “topped off” with an uncertainty margin that is selected from “experience or installer judgement”, which most likely refers to a common praxis/convention within the long-term yield assessment (LTYA) sector.

For the cost elements, depending on the character of the project, the capital expenditure (CAPEX) represents either the construction cost or the project sale price. In a few cases, the considered technical assumptions are clear before the final CAPEX value is determined. Furthermore, financial models normally only make use of a single number for the CAPEX value and it is not a common practice to account for the inherent uncertainties of the CAPEX value in the financial model. Technical assumptions are also important when determining the operational expenditure (OPEX). However, these technical assumptions are often not explicitly presented in the project presentations. Operating expenditures should reflect the expected wear-out profile of the individual components. Such expenditures should be calculated using technical parameters that describe the technical lifetime (TL-tech) profile of the equipment instead of the financial lifetime (TL-financ) of the project as these can often differ significantly. Regarding the monitoring of the plant, this typically focuses on the performance ratio (PR) and technical availability as these key performance indicators are of high importance in ensuring the overall profitability of the project.

Finally, there are different business models used in PV investments, e.g. guaranteed feed-in tariffs, green certificates, tax credit, self-consumption (in whole or in part), private or, public sales to a third party according to a power purchase agreement (PPA).